Rural Q1 2022 Market Insights

- Ian Watson

- May 4, 2022

- 2 min read

Updated: Aug 14, 2024

GRAIN

Unprecedented volatility in agricultural markets

Logistic constraints limit the local cash price increase

Global stocks are already tight

Price action in the past quarter has been dominated by the invasion of Ukraine by neighbouring Russia. The unprovoked military action has turned the global supply of wheat, corn and veg oils upside down and threatens global food security. This comes at a time when global stocks of wheat, corn and soybeans were already at historically tight levels.

CATTLE

Northern monsoon fails

Covid causes processing disruptions

Brazil exporting 90CL to US market at subsidised prices.

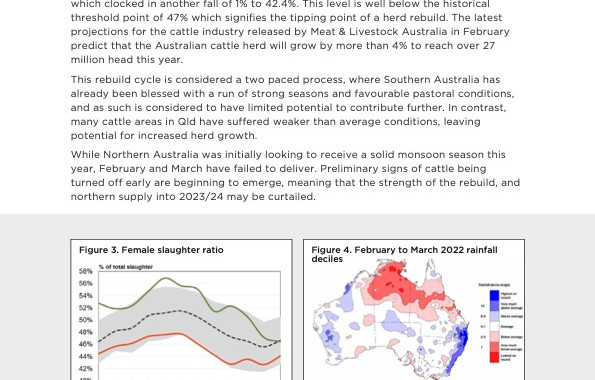

With record highs being set by the Eastern Young Cattle Indicator (EYCI) almost becoming a monotonously regular occurrence, the strong run came to an end early this summer. The index reached its peak at 1,190¢/kg, just prior to Australia day. This was followed by a sudden drop, and since that point, the price for young cattle has drifted downwards.

LAMB & SHEEP

Processing capacity constraints drive prices lower

Export demand remains strong

Sheepflock11% higher in 2021

Over the long term, the story of lamb and sheep markets has been one of growing demand. This has driven the trend of “higher highs” and “higher lows” for price – music to the ears of Australian sheep producers. While there is nothing wrong with demand for lamb offshore, slaughter capacity issues have taken the shine off the market in recent months.

WOOL

Merino market follows the general lead of apparel fibres

Sales volume excellent

Quality system volumes are low with big premiums for RWS

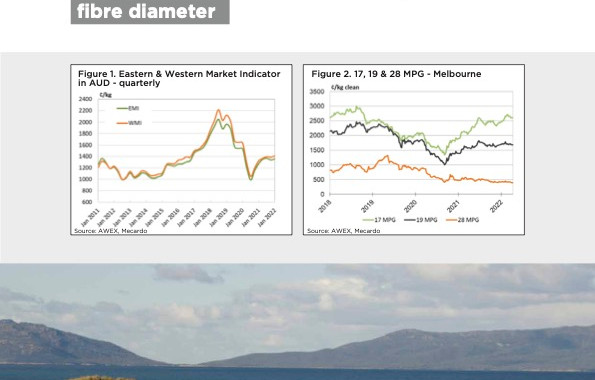

After falling to new cyclical lows in mid-2020 apparel fibre prices rebounded in 2020/21, with Merino prices stabilising through 2021/22 (to date). Not all rebounds were equal with fine Merino prices returning to be close to 2018 peak levels while the broader Merino prices remain slightly below their pre-covid levels.

Download the full report below.

Comments